Getting The Aarp Medicare Supplement Plan F To Work

Wiki Article

Top Guidelines Of Aarp Medicare Supplement Plan F

Table of ContentsNot known Factual Statements About Plan G Medicare How Hearing Insurance For Seniors can Save You Time, Stress, and Money.Manhattan Life Assurance for DummiesA Biased View of Aarp Medicare Supplement Plan FFascination About Largest Retirement Community In FloridaThe Ultimate Guide To Attained Age Vs Issue Age

This might consist of points like pay stubs, financial institution declarations, or tax return information. If you're signed up in the QMB program, you'll need to reapply for it each year. This is because your income as well as sources may change from one year to the following. Your state's Medicaid workplace can provide you info regarding when and how to reapply.

You can enroll in the Extra Aid program on the SSA website. When you're enrolled in Additional Aid, the SSA will certainly review your income as well as resource condition annually, generally at the end of August. Based on this evaluation, your Bonus Assistance advantages for the forthcoming year might stay the same, be readjusted, or be terminated.

For more details regarding the QMB program in your state, contact your state's Medicaid workplace. They can assist you identify if you're qualified and also offer you all the details required to apply. The info on this site may aid you in making individual choices regarding insurance coverage, but it is not planned to offer recommendations regarding the acquisition or use of any type of insurance or insurance coverage products.

Not known Incorrect Statements About Hearing Insurance For Seniors

On April 1, 2016, the majority of Iowa Medicaid programs were signed up with together right into one managed care program called IA Health Web link. A lot of existing Medicaid participants were registered in IA Health Web Link on April 1, 2016, and a lot of brand-new members who end up being qualified after April 1, 2016, will likewise be enlisted in IA Health Link - when to apply for medicare.

Medicaid attends to some solutions not covered under Medicare, such as dental expenses and also some prescription medicines. If your overall countable earnings or resources are higher than the QMB restrictions, there are various other program you may get: Clinically Needy: Ask the DHS office about Clinically Clingy if you have lots of medical costs as well as inadequate cash to foot the bill.

The Ultimate Guide To Manhattan Life Assurance

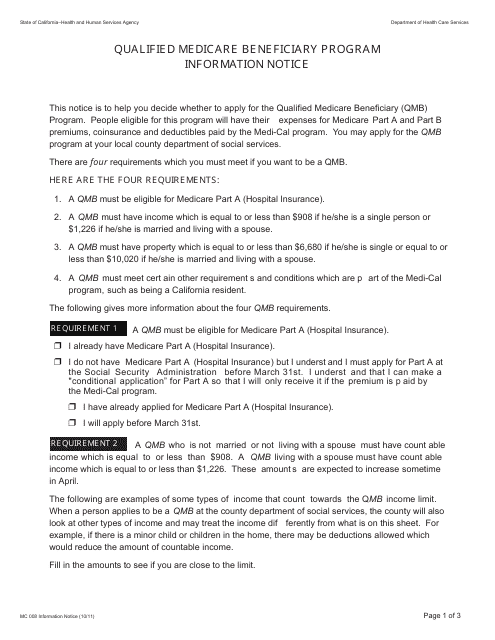

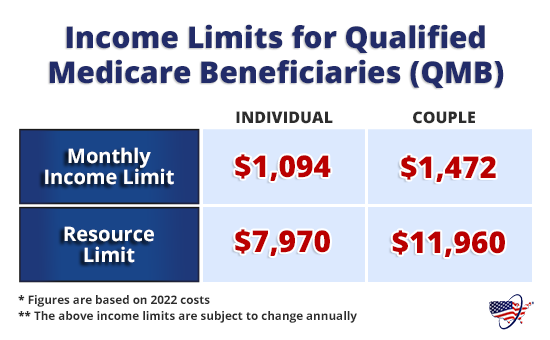

Listed below, we go over the advantages as well as eligibility requirements of the QMB program. Next off, we check out the distinction between original Medicare and also Medicare Benefit when it come to QMB. We look at the other 3 programs that aid with Medicare expenses. We may use a couple of terms in this piece that can be helpful to recognize when choosing the most effective insurance strategy: This is an annual quantity that a person need to spend expense within a certain amount of time prior to an insurance firm starts to money their treatments.For Medicare Component B, this pertains to 20%. This is a set buck quantity that a guaranteed individual pays when obtaining particular therapies. For Medicare, this generally puts on prescription medicines. The QMB Medicare savings program can assist people with low earnings pay their Medicare prices. The QMB program is just one of four state-run programs that assist people that can not manage their Medicare prices.

The QMB program pays for the following: Component A month-to-month costs, Component B month-to-month premiumscopaymentscoinsurancedeductibles, In enhancement, QMB aids with prescription expenses.

How Attained Age Vs Issue Age can Save You Time, Stress, and Money.

This suggests that more than 1 in 8 Medicare recipients are in the program. Whether a person is signed up in initial Medicare or Medicare Benefit, they are eligible for QMB if they fulfill the income as well as source needs.With this in mind, even if a person believes they may not get a program, they might want to apply. Individuals that have an interest in the programs can make use of this tool to locate their local state as well as just how to apply. hearing insurance for seniors. Below are the summaries as well as qualification needs of each program.

An individual needs to make an application for the QI program annually. The program approves applications on a first-come, first-served basis, however it provides concern to somebody who is already signed up. Below are the qualification demands for earnings as well as sources in a lot of states for QI: A person's regular monthly earnings should be under $1,456.

All About Manhattan Life Assurance

An individual's resources must be under $4,000. A married couple's sources need to be under $6,000. Somebody might quality for QDWI if click here to find out more one of the listed below problems use: They do not obtain medical help from their state. medicare part g. They are a working disabled individual under age 65. They lost premium-free Part A when they went back to function.The information on this site may help you in making personal decisions about insurance coverage, however it is not meant to give advice concerning the purchase or use of any type of insurance or insurance items. Healthline Media does not transact business of insurance in any kind of fashion as well as is not certified as an insurance provider or producer in any U.S (aarp medicare supplement plan f).

Healthline Media does not advise or support any type of third events that may transact business of insurance policy.

Get This Report about Manhattan Life Assurance

Individuals or married couples have to have income at or below 100% of the Federal Poverty Degree (FPL). These limits apply to personal possessions consisting of money, financial institution accounts, supplies and also bonds. These limits do not include home, automobile or $1,500 in funeral fund.

Report this wiki page